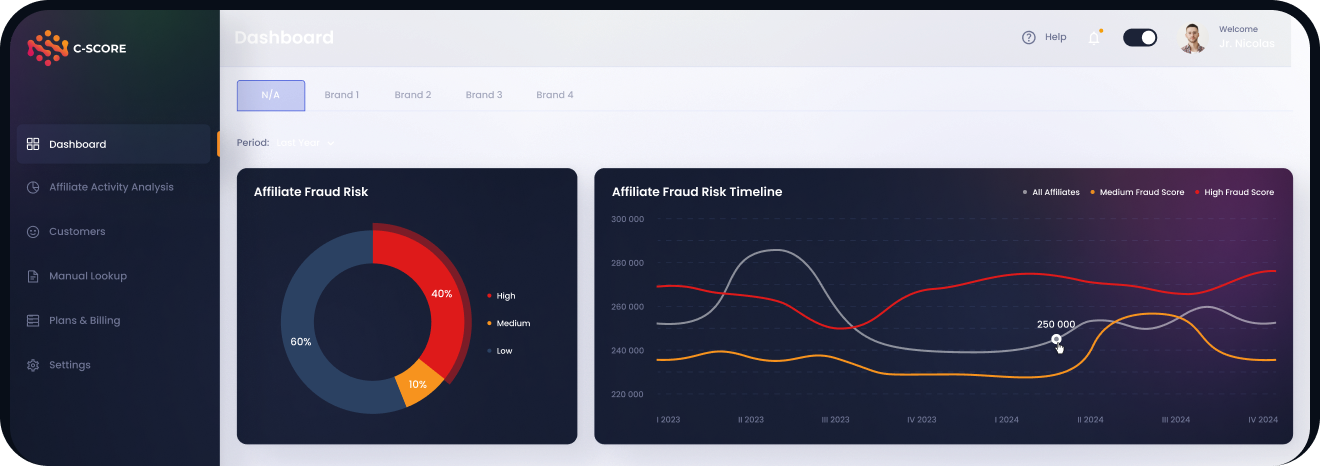

Безопасные платежи с нулевым риском потерь

C-SCORE анализирует транзакции в режиме реального времени, выявляет подозрительную активность и предотвращает финансовые потери

C-SCORE анализирует их действия и предотвращает потери.

Финансовые потери из-за мошенничества с платежами одна из самых серьёзных проблем бизнеса

Использование украденных карт

Мошенники совершают покупки с чужими картами, и владелец запрашивает возврат средств

Чарджбек Мошенничество

Пользователь запрашивает возврат средств, сохраняя продукт или выигрыш

Фрод с выводом средств

Искусственное накопление баланса и нелегальный кэш-аут

C-SCORE использует многоуровневый анализ платежей

Объединяя алгоритмы поведения, машинное обучение и анализ транзакций

Система становится умнее с каждой обработанной транзакцией

Непрерывное обучение и динамические обновления

Обновление базы данных мошенников в режиме реального времени

Выявление улучшается с каждым случаем

Автоматическое добавление новых мошеннических схем

Непрерывное обновление базы данных украденных карт

Предотвратите мошенничество ещё до его наступления

01

Снижение потерь от чарджбэков и украденных карт

02

Блокировка мошеннических транзакций без ущерба для реальных клиентов

03

Минимизация финансовых рисков и репутационных угроз

04

Гибкая настройка правил и триггеров под вашу платформу

Предотвратите мошенничество ещё до его наступления

Безопасные платежи без сложного настройки

Нулевой компромисс в удобстве пользователей или бизнес-процессах

Результаты в цифрах

Сколько вы можете сэкономить с C-SCORE

До 70%

предотвращённых мошеннических транзакций

на 85%

снижение чарджбэков

30%

уменьшение ложных блокировок платежей

Попробуйте C-SCORE и защитите ваш бизнес от мошенничества с платежами

Заполните форму обратной связи и узнайте, как ваш бизнес может выйти за рамки стандартной защиты и получить ощутимый рост

©C-SCORE TM, 2023-2025. Все права защищены.

Блок 14 эт. 1-2, Стимфалидон 52, 4046, Лимассол, Кипр

Наверх ↑

разработано yuno.team